2023 poses a challenging year for the nonprofit sector, with economic uncertainty, labour shortages, and rising costs threatening the financial stability of both nonprofit organisations and the donors funding them. With the prospect of recession looming, it is more crucial than ever for nonprofit organisations to take control of their financial data and achieve the financial performance they need to drive their core mission.

Improving your nonprofit’s financial data is no easy feat, but knowing the right steps to take and investing in the right tools to optimise your processes will empower your organisation to transform and financially flourish. ION’s new Sage Intacct Nonprofit solution will enable nonprofit organisations to meet contemporary challenges and enhance their financial data. Purpose-built to suit the unique needs of nonprofits of all types and sizes, Sage Intacct Nonprofit is a cloud-based accounting software with a robust range of powerful financial management tools. By utilising these tools to optimise and automate your 2023 financial processes, you can take control and strengthen your organisation’s financial data in 5 key steps.

1. Track your grants and billing

Accurately tracking grants and billing is an essential first step in mastering your financial data. Despite the crucial need for compliance and precise reporting, grant tracking is often a challenging and complex process for nonprofit organisations. Struggling to accurately capture costs can cause issues with both compliance and reimbursements, and make it difficult to know exactly where you stand when monitoring budgets. With costs continuing to rise, optimising your grant tracking system will provide you with the increased control and improved visibility required to strengthen your financial data and ultimately drive mission success.

To address these very issues, Sage Intacct Nonprofit features a centralised automated grant tracking and billing system, purpose-built to improve the delivery, reimbursement, reporting and audit of your grant awards. Whether you manage several grants or rely on just a few, centralising your grant financial data and documents in once secure place provides the clarity needed to make better data-driven decisions, flag potential issues, and widen visibility into mission delivery progress. With secure comprehensive views regardless of the award type or funding source, Sage Intacct offers a single place for tracking grants and projects and allows you to monitor mission progress efficiently and provide a single shared source of truth for staff and auditors.

Alongside increased visibility, an automated grant and billing tracking system will reduce billing errors and increase compliance. Where organisations struggle with monitoring and reporting on the unique needs and costs of their programmes, Sage Intacct minimises the risk of errors by integrating everything, from programme-specific details to employee timesheets, into grant records and reports. Billing errors are reduced by associating accounting entries with grants and flagging qualified expenses at entry for future reimbursements and audits. With one click in this system, eligible charges can be gathered for reporting and billing, actuals can be compared to budgets, and auditors have access to a clear audit trail. Upgrading your grant tracking and billing process will not only help your nonprofit streamline compliance, track progress, and optimise budgets, but it will also free up time and resources that can be refocused on your organisation’s core mission.

2. Use an Intelligent General Ledger

Using a modernised and intelligent general ledger is not only an important second step in improving your nonprofit’s financial data, but will also provide you with a newfound ability to make agile, data-driven decisions. The modernisation of accounting software in 2023 means there is no longer a need for financial officers to perform the repetitive and time-consuming task of manual data entry and report compilation in order to close. Investing in an intelligent and modernised general ledger will instead free up this time and arm your team with the comprehensive insights and real-time capabilities required to make lasting change.

Removing the need to wait until close to get the information you need, Sage Intacct’s Intelligent GL provides continuous, accurate accounting and captures data in real-time, ensuring that your books are always ready for reporting. In addition to boosting efficiency by eliminating outdated manual efforts, Intelligent GL offers the unique advantage of instantly being able to detect anomalies. Using advanced AI outlier detection, anomalies are highlighted at entry to ensure your data is always accurate, compliant, and trusted. Why keep waiting for close to review the information you need? Embracing a modernised and intelligent general ledger will reduce the time it takes to close, eliminate manual data entry, and arm your team with the powerful real-time insights they need to identify risks, maximise opportunities and propel your nonprofit’s growth towards mission success.

3. Stop human errors with Accounts Payable Automation

Like every organisation, nonprofits are faced with the ongoing challenge of human error. With financial skill shortages and the increasing need for accuracy and compliance, identifying areas where human errors can be minimised is an important step for your nonprofit to improve its financial data, but knowing where to begin is not always straightforward. Looking at your payment processes is a great place to start. This is where investing in the right technology, automating your accounts payable processes, and removing human errors can save your organisation thousands of pounds and countless hours of work.

Sage Intacct Nonprofit provides an automated AP workflow that gives you real-time visibility and cuts your AP processing time by an average of 65%. By automating manual processes, it eliminates inefficient workflows, reduces any opportunity for human error, and saves days of precious time usually spent on processing. Sage Intacct AP utilises a virtual assistant to remove one of the largest culprits for generating human errors, manual data entry. Alongside automated data entry, it allows your nonprofit to seamlessly connect banks, suppliers, and payment platforms to automate payments, use paperless routing for approvals, and manage your entire AP process, from supplier and bill creation through to reconciliation and reporting, in one seamless solution. Automating and centralising your AP offers you complete visibility and traceability and enables data to flow seamlessly from your banks to your general ledger so that you always stay on top of cash flow. Eliminate unnecessary human errors, manage risks, and maximise your growth potential by automating your accounts payable workflow.

4. Use multi-dimensional reporting to dissect your financial data

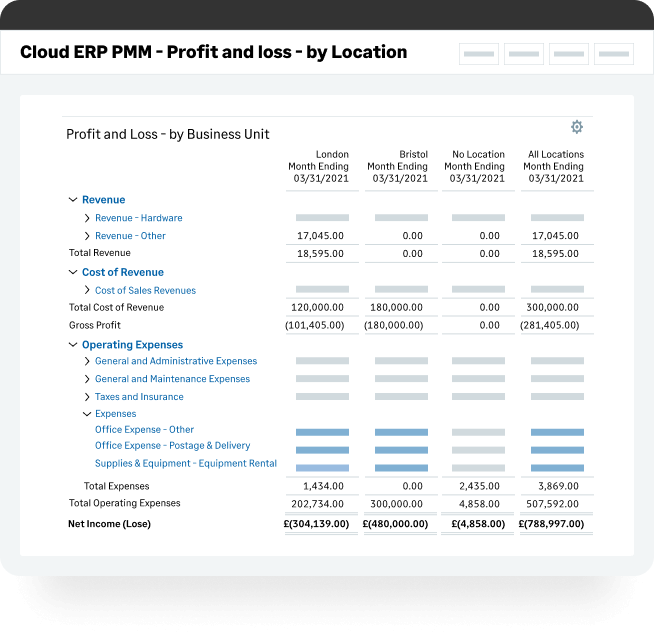

Upgrading your nonprofit’s reporting system is the next stepping stone to improved financial data. If you want your nonprofit to grow, you need a multi-dimensional reporting system that grows alongside it. How many hours does your team lose to the complexities of an ever-multiplying chart of accounts just to get to the metrics that matter? With the right software, this time-consuming process that once took days, can be at your team’s disposal in just a matter of minutes.

Designed to reduce the need for hard-coded segment combinations, Sage Intacct’s flexible dimensions will give your nonprofit never-before-seen tracking and reporting capabilities that will amplify and augment your financial data, saving days of work in the process. Eliminating the need to hardcode individual accounts, Dimensions enables users to independently ‘tag’ transactions with dimension values, and use dimensions for any transaction including general ledger, receivables, payables, time, and more. This allows your nonprofit to easily dissect financial data for reporting and analysis that is more focused and more efficient than ever before.

For the accounting team, this streamlined process means making fewer adjustments to close, quicker access to and delivery of key financial reports, and the ability to close the books in record time. For your nonprofit itself, with tagging and dimensions you have the ability to closely dissect your financials with more granular operational and financial data tailored to your organisation. As your nonprofit grows and inevitably changes, you can add the dimensions you need to easily track what’s important to you right now in 2023. If you want your organisation to focus on its purpose, not its account numbers, embracing multi-dimensional reporting will free up your time and empower you with the metrics that matter in just a few clicks.

5. Use dashboards to clearly see your performance and financial health.

In the final step for improving your nonprofits financial data, visibility is key. Having a clear overview of your financial data and documents is essential in allowing you to make data-driven decisions to minimise risks and maximise growth. Financial dashboards are an ideal medium for sharing information and gaining analytical insights. Creating dashboards that work for you and your team’s needs will allow you to consolidate complex reports and insights so that you can focus on the data that really matters.

Featuring an interactive custom report writer that lets you easily create real-time reports, Sage Intacct Nonprofit financial dashboards provide the insights you need in seconds so that your team can make the agile data-driven responses required in 2023. Designed with usability and customisation at its core, Sage Intacct allows you to create your optimal dashboard with a simple drag and drop design.

Understanding that there isn’t always a ‘one-size-fits-all’ when it comes to the right dashboard for the right person, you can create multiple dashboards and grant access to specific groups or users. This means that you can empower your team by giving the right data to the right person with their own personalised dashboard — it’s the efficient solution to an array of different processes as your team and organisation grows and adapts to the challenges of 2023.

Containing visual indicators of key financial insights, dashboards provide real-time visibility into project progress and allows potential risks to be detected ahead of time. If your team is still losing hours by trailing through spreadsheets, and getting lost in documents and folders, upgrading to personalised financial dashboards will give them the numbers they need within seconds.

In summary, 2023 poses a period of unprecedented change and economic uncertainty within the nonprofit sector. However, when armed with intelligent automated accounting software, nonprofit organisations can improve their financial data in 5 steps: tracking their grants and billing, using an intelligent general ledger, reducing human errors by automating accounts payable processes, utilising multi-dimensional reporting and tracking, and optimising their financial dashboards for a clear overview of their financial health. Sage Intacct’s cloud-based accounting software will arm nonprofit organisations with the tools they need to take each step in their stride, free up time and resources to drive their mission, and allow them to financially thrive in 2023.